Learn about how our software's Cash Flow tools can help you optimize and plan your business's cash flow.

Have you ever woken up in the middle of the night in cold sweat after a terrible nightmare about payroll not being sent out to your employees because of insufficient funds in your bank account?

Many business owners, startup founders, and CFOs have suffered thru this anxiety. Our own Fractional CFO team has direct experience navigating the anxiety that comes with managing startups and new SMBs who have cash flow management issues.

So we created a tool to make sure that you sleep straight through the night.

Our software team worked with our internal team of Fractional CFOs to understand how they were currently managing their client’s cash flow reporting and projections.

Typically they would go into the client’s bank accounts, pull the transactions into an Excel, add categories to each transaction for mapping purposes and then create 13 week cash flow table by using a series of complex formulas. Each time they had to update this file with new data they often had to update these formulas and add the categories to the mapping otherwise the formulas wouldn’t work.

Imagine pulling in hundreds of transactions at month end, each with unique identifiers and then having to go line by line to add the category name. Not ideal.

Additionally our CFOs would need to not only update the formulas/raw data sheets but also update their 13 week cash flow tables. They’d need to insert new columns, drag over formulas, hide older columns and a bunch of other formatting tricks to be able to deliver the consolidated 13 week cash flow sheet to their clients.

For companies without an internal/external finance resource, most of the time its a game of guesstimation. The owners/founders/operators would do some back of the napkin math to estimate whether they would be able to meet payroll for the next pay cycle. This practice often leads to the middle of the night nightmares and cold sweats. With our Cash Flow Tools business owners will be able to easily check in on an accurate view of their cash flow status.

To tackle the problem we obviously needed banking data. So we went to the industry leader in banking data - Plaid. For those unfamiliar with Plaid, its a software company with API connections at over 10,000 banks. Whether your business runs through Bank of America, Chase, or Mercury we’re able to securely pull in your bank transactions to Kordis.

The process takes about 5 minutes. You simply head over to our Integrations page, select the Plaid integration option and proceed to choose your bank to pull in your data.

Once you’ve pulled linked your bank account and our system processes it, you can navigate over to the Cash Flow Dashboard.

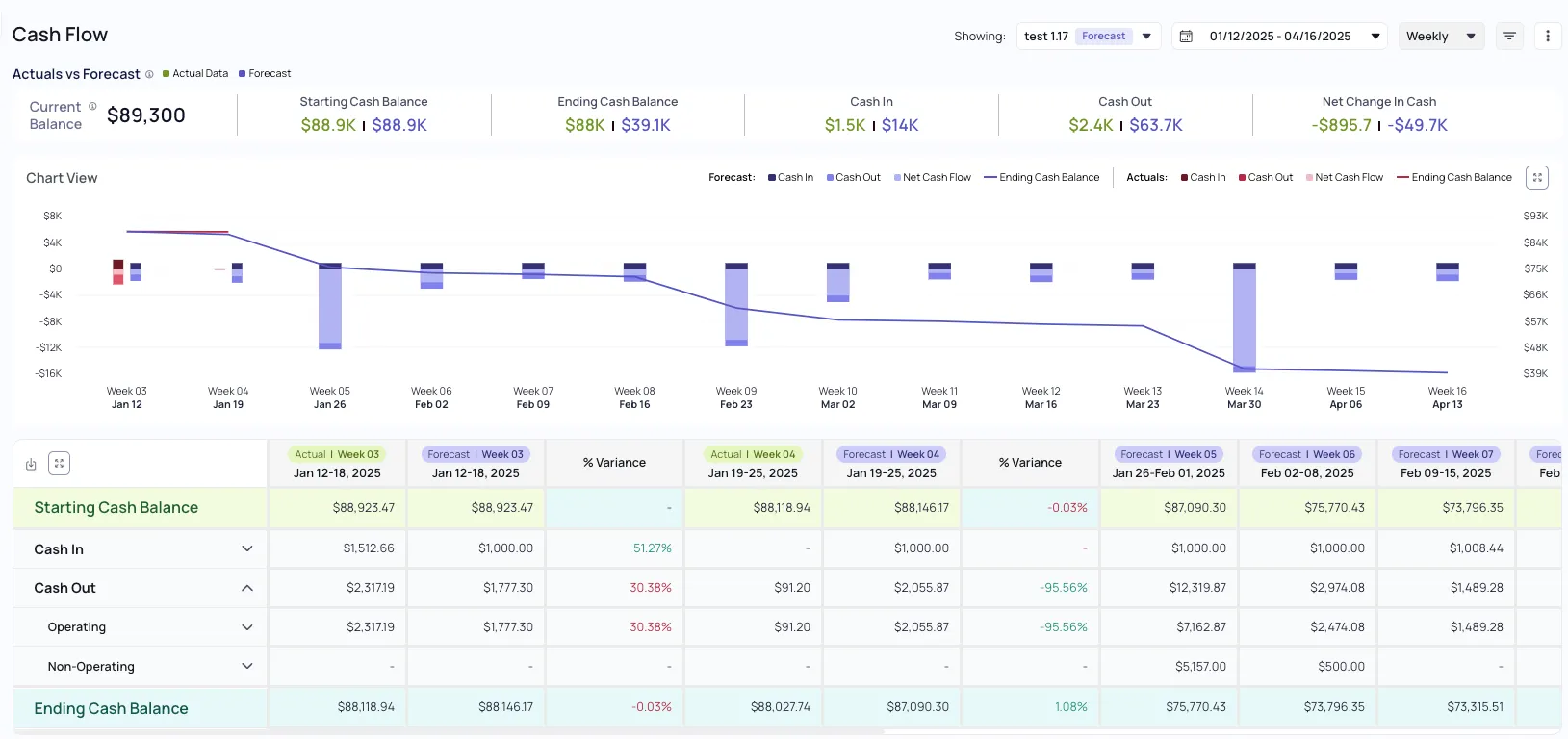

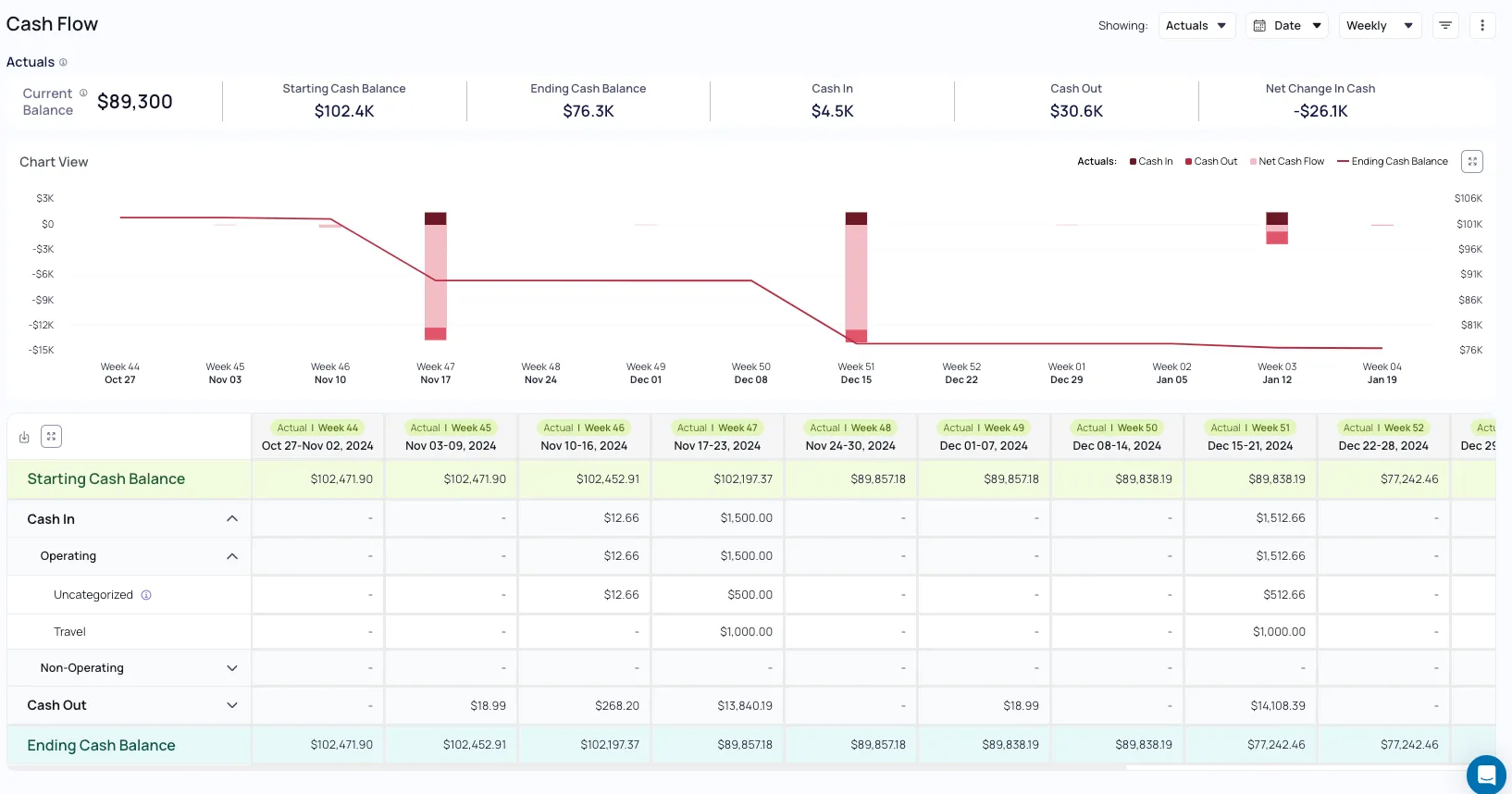

The first thing you'll see are data tiles and a combo chart on the top half of the page. By default you'll see your last 13 weeks of cash flow data. Your Current Balance tile represents the amount you have in your bank accounts as of today. The other four tiles will update based on your date settings which you can toggle in the right hand corner. The combo chart shows your Cash In, Cash Out, Net Cash Flow, and the Ending Cash Balance of each period represented by the line chart which is connected to the right axis. The other metrics are represented by the bar chart and tied to the left axis.

If you expand Cash In or Cash Out you’ll see two other line items labeled as Operating and Non-Operating. These can also be expanded where you’ll see a row of data labeled as “Uncategorized” under the Operating category. By default we label all of of your transactions as “Uncategorized”. However you can label all of your transactions under more categories in our Transactions Table which we’ll get to next.

By default we pull in the last 365 days of transactions for your business. You can use the date picker to look at data outside of the 13 week period. You also have the option to view your cash flow in Monthly increments if you’d like to.

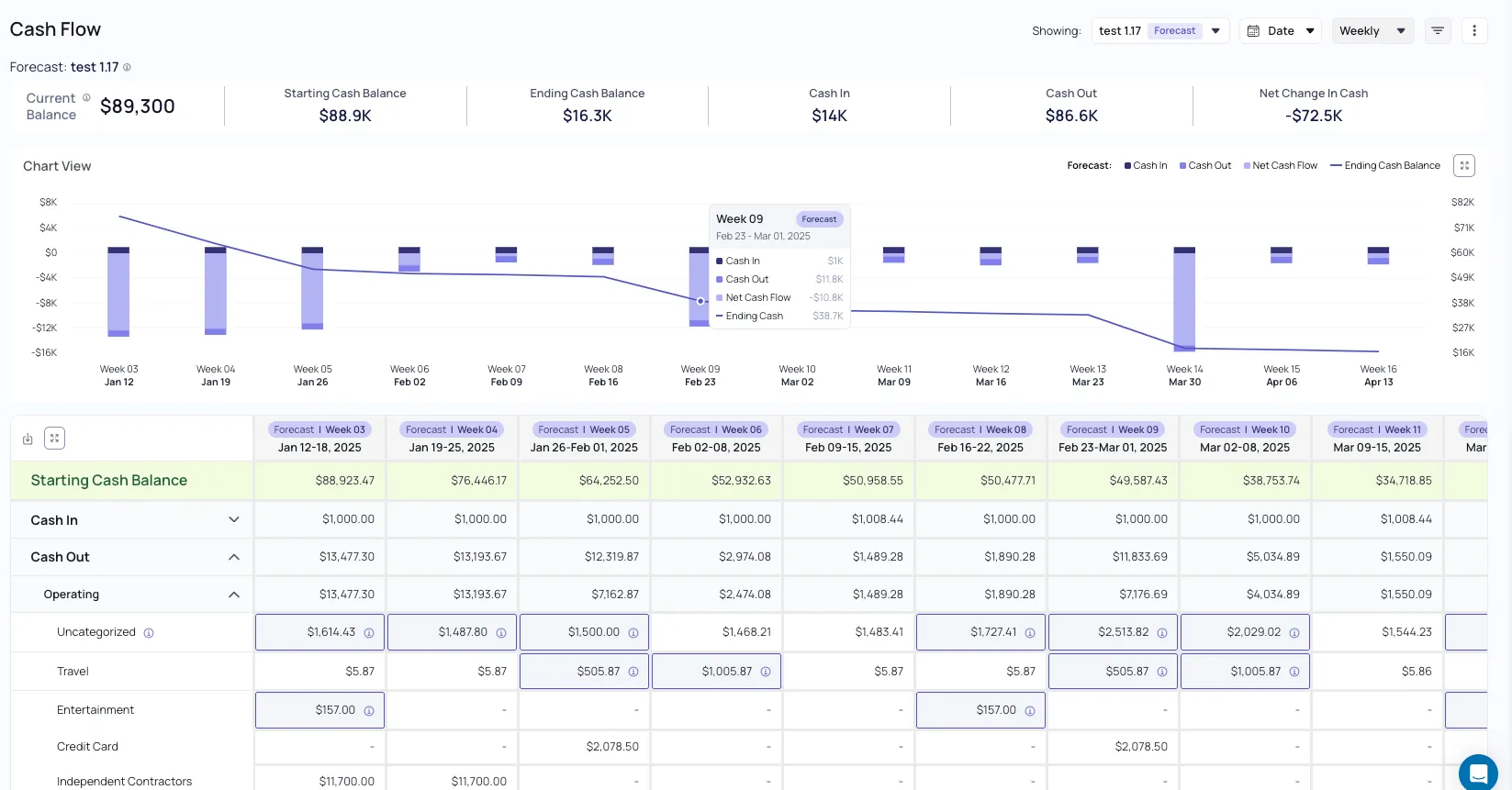

Aside from looking at actual cash flow, we built the ability to easily create a forecast so that you understand whether your business is at risk of running out of cash. Simply select the Create a Forecast button and select how many weeks/months you would like to create a forecast for. We then use machine learning to project what your cash flow should look like in the upcoming period.

After you complete this you’ll have a new set of columns that show your Forecasted Cash Flow. If you feel that some of our projections are off, no worries. You can easily adjust our projections under Receipts/Disbursements by double clicking into a category cell.

You also have the ability to add future transactions to a forecast. Let’s say you know you have a large payment hitting your bank account that hasn’t happened in the past. Simply select the three dot menu in the top right corner, select "Add Transaction" and "Create Your Own" then fill in all of the details about the transaction. After you submit it, the forecast will update accordingly.

Lastly we recently added the ability to pull in Ramp bills into your cash flow forecast. If you use Ramp to handle bill pay then you can head over to the Integrations page and connect your Ramp account assuming you're an admin of the Ramp account. After you're connected you can select the "Add Transaction" button via the three dot menu again and this time select "Billing Partner". You should your Ramp integration which you'll select and then should see all pending accounts payables or bills. Select which bills you'd like to add to the forecast and also decide whether you would like to sync future bills via the toggle at the bottom. Toggling this on will mean that Ramp bills will automatically be added to the forecasts. From there you'll select which forecasts you'd like to add the bills.

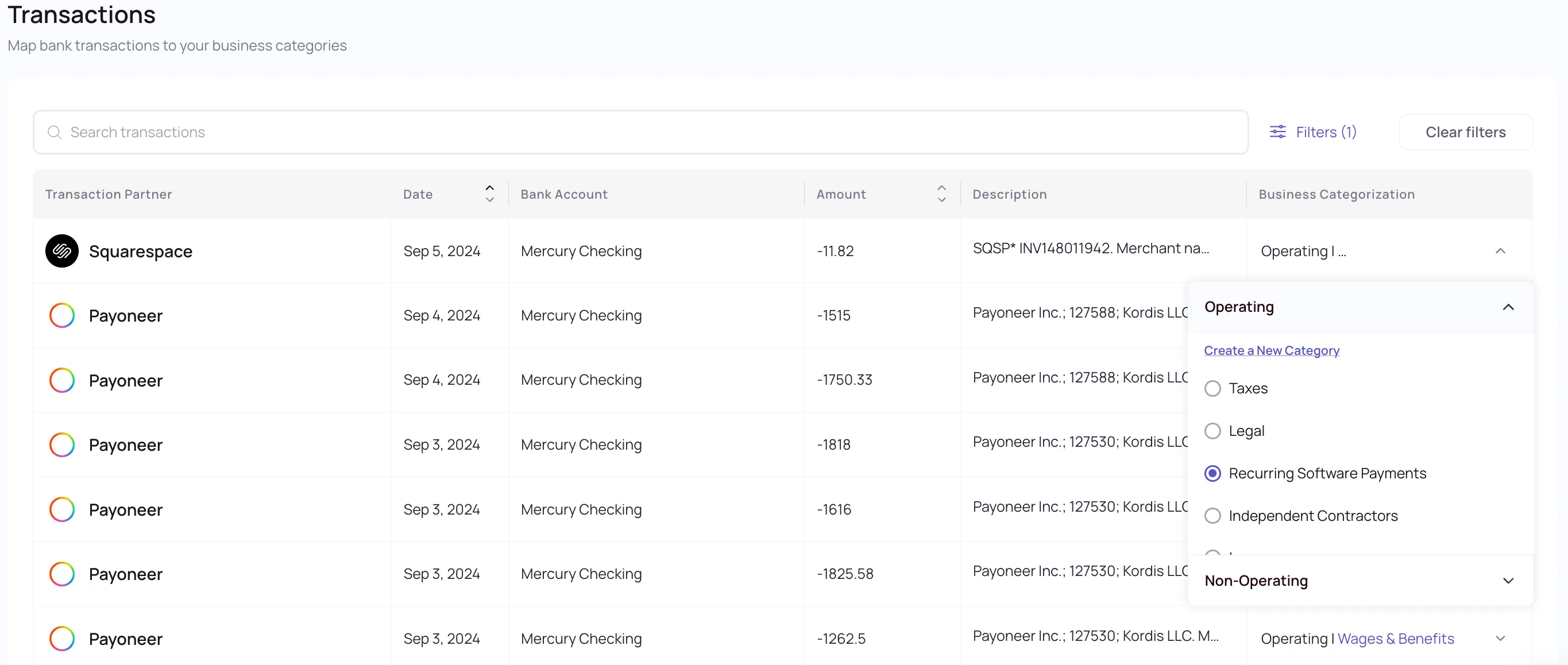

One of the issues our fractional CFOs ran into was needing to constantly label each of their clients transactions. While our CFOs are Excel wizards, not everything can be solved with a VLOOKUP.

Labeling transactions is important for analysis. Without labeling each of the transactions you have no idea when certain areas of your business are draining your bank accounts. One that comes up often is Software Subscriptions. Over time these can build up and go unnoticed. Suddenly one month you’re in a cash crunch and realize you have thousands of dollars of cash going out each month because of software subscriptions.

Therefore we created the Transactions Table for users to label their transactions into Categories.

Once you categorize your transactions your Cash Flow Table will update accordingly.

Additionally we realize that categorizing hundreds of transactions can be daunting. Therefore we give you the option of automatically bulk categorizing transactions from frequent transaction partners. For example in the above you’ll note that Payoneer is listed several times. Once you apply a category to Payoneer we’ll ask you if you would like to use that category for all past and future transactions that way you don’t need to categorize transactions in the future.

Our software is currently in open Beta so you can start using our Cash Flow tool now for no cost. Sign up today for a free trial and if you have any feedback feel free to reach out to me directly at roberto@kordis.io. We’re always looking to improve our product and features based on customer feedback.